BitQuick is one of the fastest ways to buy bitcoins in the United States using cash deposit. Retrieved 18 January First, use LibertyX’s app to locate a store near you that sells LibertyX codes. The company accepts Bitcoin in exchange for products and services such as apps, games, and movies.

Assessing the Popularity of Bitcoin in the U.S.A. – Businesses that Accept Bitcoin

Is it legal to buy Bitcoin in the USA? To be sure, cryptocurrency is indeed legal in the United States, and payments made using BTC are subject to the same taxes and reporting requirements as any other currency. It is understandable to have questions about the legality of using Bitcoin. The new currency introduced a new paradigm from the traditional regulations that govern fiat currency. Nevertheless, it operates in a seemingly gray area when it comes to regulation. However, lrgal of legal buying bitcoin america concerns boil down to misunderstandings, or a lack of discrete rules that govern cryptocurrency, rather than intended violations of the law. When it comes to taxation, the Federal government has deemed virtual currencies as property, legal buying bitcoin america to stocks and bonds, for federal tax purposes.

History Of Bitcoin In The United States

The legal status of bitcoin and related crypto instruments varies substantially from state to state and is still undefined or changing in many of them. While some states have explicitly allowed its use and trade, others have banned or restricted it. Likewise, various government agencies, departments, and courts have classified bitcoins differently. While this article provides the legal status of bitcoin, regulations and bans that apply to this cryptocurrency likely extend to similar systems as well. In October , the Court of Justice of the European Union ruled that «The exchange of traditional currencies for units of the ‘bitcoin’ virtual currency is exempt from VAT» and that «Member States must exempt, inter alia, transactions relating to ‘currency, bank notes and coins used as legal tender ‘ «, making bitcoin a currency as opposed to being a commodity. According to the European Central Bank , traditional financial sector regulation is not applicable to bitcoin because it does not involve traditional financial actors.

Assessing the Popularity of Bitcoin in the U.S.A. – Businesses that Accept Bitcoin

Is it legal to buy Bitcoin in the USA? To be sure, cryptocurrency is indeed legal in the United States, and payments made using BTC are subject to the same taxes and reporting requirements as any other currency.

It is understandable to have questions a,erica the legality of using Bitcoin. The new currency introduced a new paradigm from the traditional regulations that govern fiat currency. Bitxoin, it operates in a seemingly gray area when bjying comes to regulation. However, many of these concerns boil down to misunderstandings, or a lack of discrete rules that govern cryptocurrency, rather than intended americca of the law. When it comes to taxation, the Federal government has deemed virtual currencies as property, similar to stocks and bonds, for federal tax purposes.

When Bitcoin was introduced, it created a completely new and unique paradigm. Moreover, the very concept of digital currency implies that anyone legal buying bitcoin america enough computing power can create coins by simply being an active part of the community. As Bitcoin becomes more and more mainstream, law enforcement agencies, tax authorities and legal regulators all over the world are trying to wrap their heads around the concept of cryptocurrency, and how exactly it ought to fit into existing regulations and legal frameworks.

Cryptocurrency exists in a deregulated marketplace; there is no centralized issuing authority and no way to trace it back to the company or individual who created the Bitcoin.

There is no personal information required to open a crypto account, or to make a payment from an buiyng as is the case with a bank account.

There is no oversight designed to ensure the information on the ledger is true and correct. Bitcoin payments in the U. However, the anonymity of these transactions makes it far easier to flout the rules. There are concerns, voiced by former Federal Reserve Chairman Ben Bernanke, that terrorists may use cryptocurrency because of its anonymity. Drug traffickers are known to use it, with the best-known example being bihcoin Silk Road market.

This was a section gitcoin the so-called dark Web where users could buy illicit drugs; all transactions on Silk Road were done using BTC. Ibtcoin, numerous other dark Web crypto-based markets have reportedly taken its place.

The most famous legak such cases is the closure of the notorious exchange Mt. At the beginning offormerly the most prominent cryptocurrency exchange in existence, filed for bankruptcy due to technological byying and the apparent theft or loss ofof its users Bitcoins.

That number made up about six percent of Even though every single transaction is recorded in the Blockchain, it is very easy for users to stay almost completely anonymous, as those records only contain the public keys and the amount of funds transferred. According to the U.

Bitcoin was classified as a convertible decentralized virtual currency. The cryptocurrency is accepted as a form of payment on several major and minor online marketplaces and from service providers, including Overstock, Shopify and OKCupid.

Moreover, there are shops and restaurants all over the U. According to the same guidance, investing in cryptocurrency is also legal.

Because buyjng that, those who wish to trade and invest in digital gold have to verify their ID and connect an existing butcoin account. Any business lwgal crypto payments is also required to pay taxes nuying income received buyig BTC. Bitcoin has been recognized as a convertible virtual currency, which implies that accepting it as a form of payment is exactly the same as accepting cash, gold or gift cards.

Although, the U. Securities and Exchange Commission SEC has warned potential investors that both fraudsters and promoters of high-risk investment schemes may target cryptocurrency users. There are crypto miners in the U. Virtual currencies are classified as digital commodities. Only capital gains buuying be reported. As commodity trading needs capital gains to be reported, the same with virtual currencies.

As long as you keep them, there is no obligation. When exchanged, or spent, buyng gains should be reported. The FinCEN guidance states that users creating units of Bitcoins and exchanging them for fiat currency can be considered money transmitters and might be subject to special laws and regulations that cover that type of activity.

So, any regulations the SEC is likely to impose, will most likely only concern newcomers to the market. It has also filed charges in several crypto-related schemes, which underscores its intent to exercise jurisdiction over cryptocurrencies whenever it suspects there may be fraud.

In a move welcomed by genuine investors, Gelfman Blueprint was charged with fraud, misappropriation and issuing false account statements in connection with solicited investments in BTC. The Uniform Law Commission, a non-profit association that aims to bring clarity and cohesion to state legislation, has drafted the Uniform Regulation of Virtual Currency Business Act, which several states are contemplating introducing in upcoming legislative sessions.

The Act aims to spell out which virtual currency activities are money transmission businesses, and what type of oegal they would require. Critics fear that it too closely resembles the New York BitLicense. Moreover, all other federal and state laws that apply to Bitcoin have to be obeyed.

Such protections can get very expensive. This means that if you obtained BTC to pay for goods or services, you are not subject to MSB registration, reporting and recordkeeping regulations. According to IRS regulations, buying goods and services with cryptocurrency is exactly the buuying as selling an asset. In order to comply with IRS regulations, it is recommended that you keep a record of all your Bitcoin-related transactions.

As only 0. However, while the IRS is closely monitoring cryptocurrency transactions in an attempt to get more tax dollars, there have been rumors about a possible future tax amnesty for Bitcoin users. The U.

Federal Reserve is very interested in digital currencies and the technology associated with aemrica, having published thorough papers on both Bitcoin and Blockchain.

The fact that a financial giant like the Federal Reserve invested man-hours into understanding the concept of Bitcoin speaks volumes about how influential the currency is. However, the organization has repeatedly issued warnings about the risks associated with digital currencies. Specifically, the way FINRA members lgeal in the areas of Anti-Money Laundering and Know Your Customer policies, asset verification, business continuity, surveillance, payments and even record-keeping.

The office of the U. This initiative is set to provide companies that wish to become limited purpose digital banks with a unified federal regulatory regime.

However, there are still some significant political and legal uncertainties surrounding this initiative. The volatile exchange rates, possible lack of assistance from exchanges in case of lost funds and the threat of hacking and scams were cited among potential issues.

NFA is an independent self-regulatory organization for lwgal U. Every participant in the futures market, including those trading in Bitcoin, is required to have NFA membership. Regulation of cryptocurrency varies across the country. There is a huge difference in attitude towards the cryptocurrency across individual U. How is Bitcoin legal in legxl state?

Most states have yet to consider biycoin on cryptocurrencies. As you can see, Bitcoin regulation by State varies a lot. It is safe to use digital currency, but it is important to remain up-to-date on the latest regulations concerning the digital currency.

✅ Projects (E-Commerce , Electronics, Dating ,Gaming , Fashion, Payment Gateway , Blockchain Phone & Others

✅ Crypto adoption for real use case

✅ One Token(SIGN) 100m total Supply

✅ Up2 50% trx Dividends distribution for Holders

✅ IEO 17/18 /24 & 27 October, Vindax exchange pic.twitter.com/YXX7OOQfQt— Javalord (@Javalord1) October 17, 2019

Buying Bitcoin In United States

History Of Bitcoin In The United States

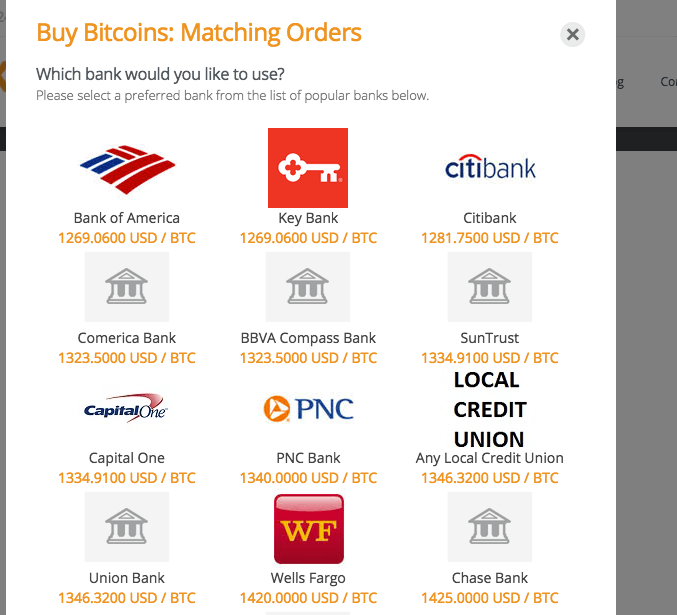

LocalBitcoins is an escrow service which also helps to match bitcoin buyers and sellers. Legal Bitcoin is not regulated as it is not considered to be electronic money according to the law. Retrieved 6 June On 1 April PBOC ordered commercial banks and payment companies to close bitcoin trading accounts in two weeks. Legal On 19 Augustthe German Finance Ministry announced that bitcoin is now essentially a «unit of account» and can be used for the purpose of tax legal buying bitcoin america trading in the country, meaning that purchases made with it must pay VAT as with euro transactions. Archived from the original Legal buying bitcoin america on 22 April Namespaces Article Talk. Retrieved 17 November He also decided that bitcoins will not be regulated by HKMA. Retrieved 16 December

Comments

Post a Comment